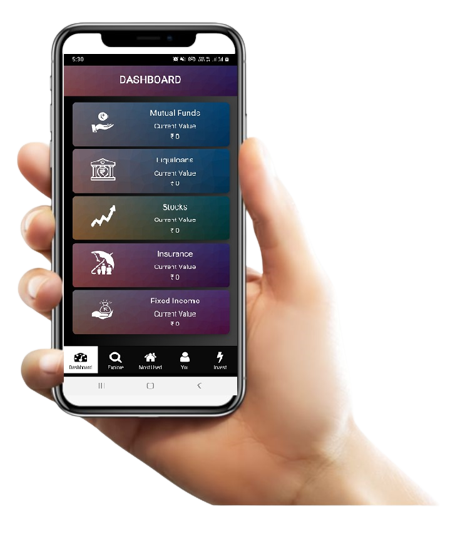

Seamless on-boarding, quick and simple

Get your existing portfolio in a jiffy

Bank Grade Security

We charge nothing from our Customers

Handpicked best Mutual Funds for you

Hours of hard work to ensure your money works for you

Use this calculator to see how small investments made at regular intervals (SIPs) can grow to a large figure over a period of time with power of compounding.

Plan for your Goals by using this calculator to determine the monthly SIP investments you need to make to reach a particular goal.

SWP helps you get a fixed amount every month. Use this Calculator to plan for your post-retirement and other regular monthly income needs.

"Riddhi's team have been superb and im so glad to have found them. The friendly help is readily on hand and speedy. The team always have been more than willing to assist and often go the extra mile. They have given many investment ideas which has helped me grow financially . Would recommend them to many." - Niharika Oberoi

"More than 10 years ago, I signed up with Ketan Bhai's service because my finances were a mess - I couldn't figure out how to save and how to plan for the future and I was terrified of making investments beyond bank FDs. Ketan Bhai listened to my fears, explained what I needed to do to make myself financially secure and gave me the confidence to step out of my financial comfort zone.

"Riddhi's team have been superb and im so glad to have found them. The friendly help is readily on hand and speedy. The team always have been more than willing to assist and often go the extra mile. They have given many investment ideas which has helped me grow financially . Would recommend them to many." - Niharika Oberoi

"I want to express my deepest appreciation for the exceptional guidance and expertise provided by my investment team.They have been instrumental in navigating me through the complex world of investments. Their insightful advice and unwavering support have not only preserved and grown my financial portfolio but also given me peace of mind. I am truly grateful for their dedication and professionalism."- Parinda Gandhi

"More than 10 years ago, I signed up with Ketan Bhai's service because my finances were a mess - I couldn't figure out how to save and how to plan for the future and I was terrified of making investments beyond bank FDs. Ketan Bhai listened to my fears, explained what I needed to do to make myself financially secure and gave me the confidence to step out of my financial comfort zone. - Kushalrani Gulab

No. 4,5, Ground Floor, Om Sai Niwas CHS, Opp. Madrasi Ram Mandir, Subhash Road, Vile Parle East Mumbai 400057